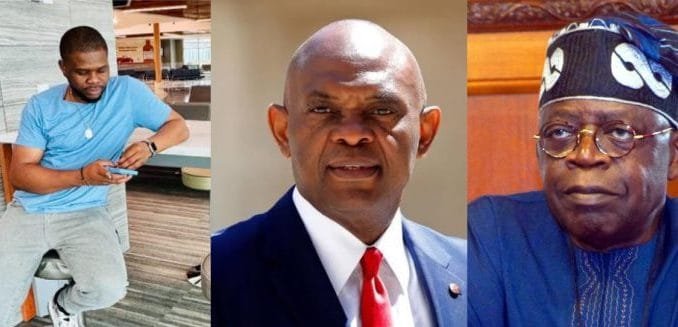

”I Withdrew Everything’- Man Closes UBA Accounts After Tony Elumelu Supports Tinubu

‘I Withdrew Everything’- Man Closes UBA Accounts After Tony Elumelu Supports Tinubu Nigerian-born health communication specialist, Ugochukwu Madu, has reportedly closed all his accounts with United Bank for Africa (UBA) following recent comments by the bank’s chairman, Tony Elumelu, in support of President Bola Ahmed Tinubu’s economic reforms. Madu announced his decision shortly after Elumelu publicly endorsed the President’s ongoing policy measures, sparking mixed reactions online. Elumelu made his remarks after a private session with the President at the Presidential Villa in Abuja. Addressing journalists, he described the government’s ongoing reforms as necessary steps to stabilise the economy and promote…