THE GOVERNMENT OF ABIA STATE IS DATA-DRIVEN AND HERE’S A REBUTTAL TO ANOTHER MISINFORMATION

I note with dismay a recent publication authored by one Ujo Justice, PhD, purporting to be on behalf of Prince Paul Ikonne. The piece, riddled with factual inaccuracies and a profound misrepresentation of the state’s financial and developmental strides, necessitates a clear, statistics-based clarification for the discerning public.

It is regrettable that the opposition has chosen a path of deliberate misinformation rather than engaging in constructive criticism based on verifiable data.

- On the ₦54 Billion “Phantom” Schools Project:

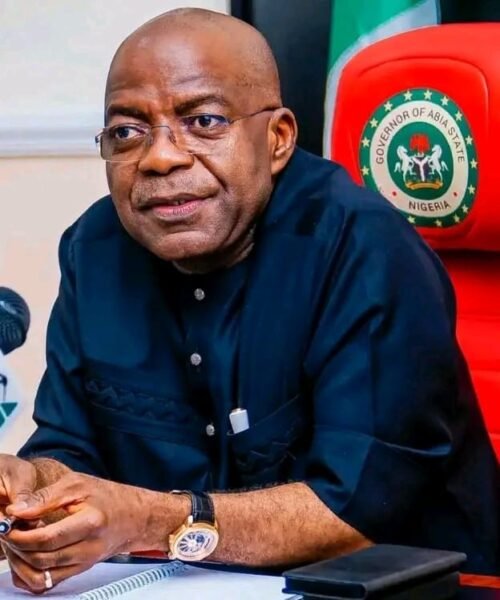

The assertion that “not a single school has been identified or showcased” is not only false but demonstrates a shocking lack of awareness of the state’s ongoing projects. The Alex Otti-led administration’s commitment to education is a matter of public record, detailed in the state’s duly approved 2024 budget.

The total budgeted capital expenditure for the entire 2024 fiscal year is ₦391.2 billion. The allocation for the construction and rehabilitation of the 51 model schools is spread across multiple fiscal years, not a single lump-sum payment as maliciously implied. The first phase of these projects is actively underway and on schedule.

Project sites have been identified and groundbreaking ceremonies conducted, with construction progress visible to any objective observer. To claim otherwise is to willfully ignore reality. The government’s transparent accounting ensures every naira is accounted for and its expenditure will be subject to public audit.

- On the “Suffocating Taxation Regime”:

The description of the state’s tax reform as “suffocating” is a mischaracterization of a necessary and structured effort to formalize the economy and increase the state’s Internally Generated Revenue (IGR) for the benefit of all.

Under the previous administration, Abia State’s IGR was notoriously low despite its economic potential. The current government is simply implementing an automated, transparent system that eliminates arbitrary collections and harassment by touts. The goal is to broaden the tax base, not to overburden existing compliant taxpayers.

The reforms target leakage and illegality, not the poor. The narrative of taxing “poor rural dwellers who only survive by tilling the earth” is a cynical and emotional ploy with no basis in the state’s actual revenue policy, which focuses on commerce and property in urban centers.

- On Federal Allocation and “Anti-People” Policies:

The claim that Abia State receives “over ₦30 billion monthly allocation” is an outright falsehood that can be easily disproven by publicly available data from the Nigerian Bureau of Statistics (NBS) and the Federation Account Allocation Committee (FAAC).

According to official FAAC records for the first half of 2024, Abia State’s average monthly allocation ranges between ₦4 billion and ₦5.5 billion. To inflate this figure by over 500% is not a mere error; it is a deliberate attempt to mislead the public and create resentment. This administration is prudently managing these resources alongside growing IR to deliver unprecedented infrastructure development.

Conclusion:

The Government of Abia State, under Dr. Alex Otti, OFR, remains steadfast in its commitment to transparency, accountability, and the transformative development of the state. We urge the public to seek information from official government channels and verified data sources rather than politically motivated fiction.

The Governor’s focus remains on delivering the “Ease of Doing Business,” quality education, and infrastructure that the people of Abia rightly deserve—a mission that is already yielding visible results across the state.

AProf Chukwuemeka Ifegwu Eke