Elite Pension Reform and Fiscal Justice: A Public Sector Economics Defense of Governance Restructuring

A Pro-Reform Governance Paper Anchored in Stiglitz & Rosengard

Modern public finance does not evaluate government spending by tradition, political sentiment, or elite expectation. It evaluates spending by social value, equity impact, and efficiency outcome. In Economics of the Public Sector, Joseph Stiglitz and Jay Rosengard repeatedly emphasize that the central purpose of public expenditure is to advance “social welfare” and correct distributional imbalance. That framework provides a rigorous lens for evaluating reforms that repeal extraordinary pension privileges for former political office holders and redirect those funds toward ordinary retirees and public service delivery.

Public sector economics teaches that budget choices must pass both the efficiency test and the equity test. Stiglitz describes policy evaluation as grounded in “distributional objectives” as well as resource efficiency. Where a pension structure disproportionately favors already advantaged elites while ordinary pensioners face hardship or delay, the expenditure fails the equity criterion. Reform in such a case is not ideological aggression — it is fiscal correction. Redirecting resources toward broad pension obligations and social services aligns spending with what the text characterizes as welfare-enhancing allocation.

The book also warns that public budgets are often shaped by what it calls “special interests” and politically powerful actors. Legacy elite pension laws fit squarely within this analytical category — expenditure lines sustained by insider influence rather than broad welfare return. Removing such provisions is consistent with what Stiglitz frames as improving the quality of public decision-making by reducing distortionary privilege embedded in fiscal structures.

Another core concept in the text is opportunity cost — the idea that every unit of public currency used in one way cannot be used in another. Stiglitz repeatedly stresses evaluating public programs by comparing “social benefits and social costs.” Funds committed to elite lifetime pensions carry high opportunity cost because they displace alternative uses with wider citizen benefit — primary healthcare, wage stabilization, infrastructure, and general pension funding. Reform therefore increases total welfare impact per budget unit.

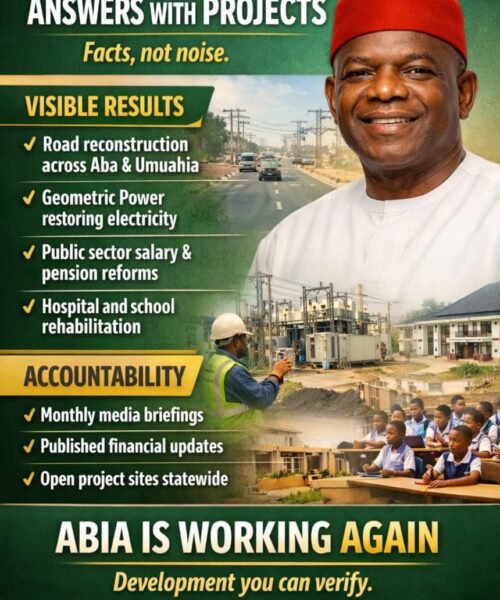

Public sector economics further supports what it terms “expenditure rationalization” — pruning low-impact, high-cost obligations to preserve fiscal space. Pension privilege repeal fits this model exactly. It is not merely symbolic reform; it is structural expenditure correction that improves fiscal sustainability and budget flexibility.

In reform economics, such measures are recognized as strengthening long-run fiscal credibility.

Stiglitz also emphasizes that good public finance must consider fairness across time — what modern fiscal literature calls intergenerational equity. Long-term elite pension burdens shift costs forward to future taxpayers without proportional social return. Removing them aligns with the book’s repeated concern for fair burden distribution within fiscal systems.

Taken together, the Stiglitz–Rosengard framework leads to a clear conclusion: repealing extraordinary elite pensions and reallocating funds toward ordinary retirees and public goods is consistent with core public sector economics principles — social welfare maximization, equity correction, efficiency improvement, and fiscal sustainability.

This is not partisan reform. It is textbook reform.

AProf Chukwuemeka Ifegwu Eke