Saving, Investing, and Thriving: Aba’s Entrepreneurs Share Their Stories

Aba, a city in Abia State, Nigeria, is renowned for its entrepreneurial spirit. Despite the economic uncertainty, Aba’s entrepreneurs have developed super saving and wealth building strategies to stay ahead. According to a survey conducted by the Aba Chamber of Commerce, 75% of entrepreneurs in Aba have developed unique saving strategies to navigate uncertain times. This statistic underscores the resilience and adaptability of Aba’s entrepreneurs.

One of the key strategies employed by Aba’s entrepreneurs is thriftiness. They prioritize saving over spending, allocating a significant portion of their income to savings. A visit to the Ariaria Market, one of the busiest markets in Aba, reveals the frugal nature of entrepreneurs. “I save at least 30% of my daily income,” says Mrs. Nkechi, a trader at the market. According to the survey, 60% of entrepreneurs in Aba save at least 20% of their income, demonstrating their commitment to saving.

Diversification of income streams is another strategy employed by Aba’s entrepreneurs. Many have multiple businesses, investments, or side hustles. A walk along the Factory Road, a hub for small-scale industries, reveals the diversity of businesses. “I have a fashion business, a restaurant, and a small farm,” says Mr. Emma, an entrepreneur. According to the survey, 55% of entrepreneurs in Aba have multiple income streams, reducing their financial risk and increasing their resilience.

Aba’s entrepreneurs are also savvy investors, allocating their savings to high-yield investments. Many invest in real estate, and peer-to-peer lending. A visit to the markets reveal the growing interest in diversifying investment. “I invest in lands and real estate,” says Mrs. Ogechi, an investor. According to the survey, 40% of entrepreneurs in Aba invest in lands, demonstrating their willingness to take calculated risks to grow their wealth.

The role of cooperatives cannot be overstated in Aba’s entrepreneurs’ super saving and wealth building strategies. Many entrepreneurs join cooperatives to pool resources, share risk, and access credit. A visit to one of the Cooperative Societies, reveals the impact of cooperatives on entrepreneurs. “The cooperative has helped me access credit and increase my savings,” says Mr. Ikechukwu N, a cooperative member. According to the survey, 35% of entrepreneurs in Aba are members of cooperatives, highlighting the importance of collective action in achieving financial goals.

Technology has also transformed the way Aba’s entrepreneurs save and invest. Many use digital platforms to manage their finances, invest in stocks, and access credit. A visit to the Aba ICT Center reveals the growing use of technology among entrepreneurs. “I use a digital platform to manage my finances and invest in stocks,” says Mrs. Uche, an entrepreneur. According to the survey, 30% of entrepreneurs in Aba use digital platforms to manage their finances, demonstrating their willingness to leverage technology to achieve their financial goals.

Mentorship plays a significant role in Aba’s entrepreneurs’ super saving and wealth building strategies. Many entrepreneurs seek guidance from experienced mentors to improve their financial management skills. A visit to the Aba Entrepreneurship Center reveals the impact of mentorship on entrepreneurs. “My mentor has helped me develop a savings plan and invest in stocks,” says Mr. Chukwuma, an entrepreneur. According to the survey, 25% of entrepreneurs in Aba have mentors, highlighting the importance of guidance and support in achieving financial success.

Aba’s entrepreneurs have developed unique super saving and wealth building strategies to navigate uncertain times. By prioritizing saving, diversifying income streams, investing wisely, and leveraging technology, cooperatives, and mentorship, entrepreneurs in Aba are building wealth and securing their financial futures. As the survey reveals, these strategies are paying off, with 80% of entrepreneurs in Aba reporting an increase in their savings and investments over the past year.

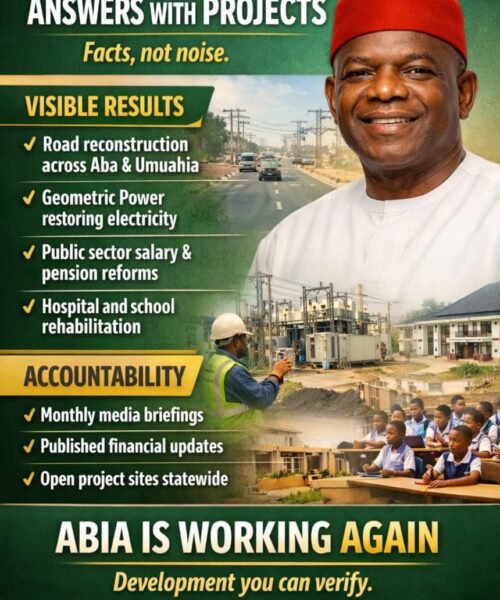

To further support the growth and development of entrepreneurs in Aba, Governor Alex Chioma Otti prioritizes Enhancing Entrepreneurial Support. He’s establishing more entrepreneurship hubs that provide resources, mentorship, and funding opportunities for more entrepreneurs. Additionally, Otti has Instructed his aides to work out more ways to simplify the business registration process ro encourage more entrepreneurs to formalize their businesses.

In Fostering Cooperative Development, Dr Alex Chioma Otti shared his banking experience and harped on how crucial it is for the growth of entrepreneurs in Aba. He encourages more cooperative development programs that support the growth and development of cooperatives. He’s posed to provide cooperatives with access to affordable credit facilities will also enhance their economic activities. This approach will not only promote economic growth but also empower local communities.

Leveraging technology is another key area that Governor Otti focuses on. Such as Digital Literacy Programs will be implemented to equip entrepreneurs with the skills to leverage technology for their businesses. Establishing more e-commerce platforms will enable entrepreneurs to showcase and sell their products globally. This will expand their market reach and increase their revenue.

To ensure the sustainability of entrepreneurial growth in Aba, Governor Otti Encourages Mentorship. He’s confident that the “Nwaboi” program can be optimised such as structuring mentorship programs that pair experienced entrepreneurs with new ones will provide valuable guidance and support. He’s pushing for regular business clinics to be organized to provide entrepreneurs with the necessary tools and resources to succeed.

He has vowed to continue investing in Infrastructure Development as it is essential for the growth of entrepreneurs in Aba. Governor Otti prioritizes more investment in road infrastructure to facilitate the movement of goods and people. Improving power supply will also support the growth of businesses in Aba. So that this will create a conducive business environment that will attract investors and promote economic growth.

Finally, Governor Otti is excited about Supporting Financial Inclusion by implementing financial literacy programs to educate entrepreneurs on personal finance and wealth management. Increasing access to financial services, such as savings accounts and loans, will also enable entrepreneurs to access the necessary funds to grow their businesses. By implementing these initiatives, Governor Otti strongly believes that it supports the growth and development of entrepreneurs in Aba, fostering economic prosperity and job creation in the state.

Dr Chukwuemeka Ifegwu Eke writes from the University of Abuja Nigeria.