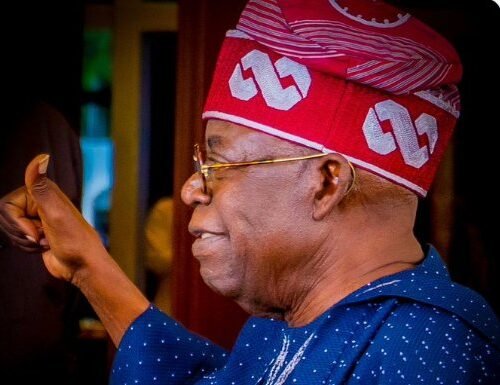

Could The Tinubu Tax Reform, be a Golden Opportunity for Abians?

Dear Abians, Governor Alex Chioma Otti is monitoring as he meticulously retooling Abia’s macro and microeconomic environment for a bumper harvest as regards this subject matter. As Nigeria prepares for the Tinubu tax reform, which seems inevitable, judging from the President antecedents, he has placed and still working very hard to place Abia and Abians so as to position themselves to reap significant benefits. Now, we know with our forward-looking Dr Otti in the saddle, Abia State has been undergoing transformative restructuring, with a focus on rebuilding and restoring the state’s economy. The Tinubu tax reform, if properly implemented presents a unique opportunity for Abia-born industrialists and Nigerian businesses to take advantage of the state’s favorable business environment.

Speaking for 93 minutes with Chief Okomba Dike, a notable figure in Abia State, Nigeria, who attended Abia State University, where he studied marketing, and made significant contributions in the past having handled World Bank projects related to water supply in Abia North, coupled with the fact that his expertise in marketing has also been valuable in his business ventures, as well as politics. He concluded that this is a golden era for Igbo businesses to take advantage of by re-registering their business head quarters in the South East to start with. To have a broader perspective, let’s delve deeper into the subject.

The Tinubu tax reform has been discussed and debated in various forums, including Channels TV Town Hall Meeting which held two days, the National Assembly, the Presidential Fiscal Policy and Tax Reforms Committee interactions with stakeholder forums. The reform’s key provisions include increasing investment incentives, improving infrastructure, providing a skilled workforce, and creating a business-friendly environment.

The Tinubu tax reform is designed to fix the economy and ensure inclusive growth, as emphasized by Taiwo Oyedele, chairman of the Presidential Fiscal Policy and Tax Reforms Committee. The reform aims to overhaul the nation’s tax system, prevent leakages, and ensure true fiscal federalism. By doing so, the Tinubu tax reform will create a more favorable business environment, attracting investors and entrepreneurs to all the Six geopolitical zones or regions, if they are as serious as is Abia State to restructure their states production ‘metaphysics’ which refers to a philosophical framework that explores the nature of reality, being, and existence in relation to human production, labor, and creativity. It examines how human activities, such as work, art, and technology, shape our understanding of the world and our place within it. By investigating the metaphysical implications of production, this framework seeks to uncover the underlying structures, relationships, and meanings that govern human existence and the world we create.

The South-South Region, for instance, can expect increased investment in the oil and gas sector, as well as the development of the Port Harcourt seaport. The South-East Region can anticipate a boost to the manufacturing sector, as well as the development of the Enugu coal mines. Similarly, the South-West Region can expect increased investment in agriculture, as well as the development of the Lagos-Ibadan rail line.

The North-Central Region can also benefit from the Tinubu tax reform, with a boost to the mining sector and the development of the Abuja-Kaduna rail line. The North-East Region can expect increased investment in education, as well as the development of the Maiduguri-Port Harcourt rail line. Finally, the North-West Region can anticipate a boost to the agricultural sector, as well as the development of the Kano-Lagos rail line.

As the Tinubu tax reform takes effect, Abia-born industrialists and Nigerian businesses are encouraged to take advantage of the state’s favorable business environment. With its improved infrastructure, skilled workforce, and business-friendly policies, Abia State is an attractive destination for investors and entrepreneurs.

The Tinubu tax reform is a critical step towards creating a more favorable business environment in Nigeria. By reducing the burden of taxation on businesses, the reform will encourage investment, stimulate economic growth, and create jobs. As Nigeria’s economy continues to grow and diversify, the Tinubu tax reform will play a crucial role in attracting investors and entrepreneurs to the country.

In addition to its economic benefits, the Tinubu tax reform will also have a positive impact on Nigeria’s social development. By increasing government revenue, the reform will enable the government to invest more in essential public services such as education, healthcare, and infrastructure. This, in turn, will improve the quality of life for Nigerians and help to reduce poverty and inequality.

In conclusion, whichever way the pendulum swings, Dr Alex Chioma Otti has laid the groundwork for Abians and Abia State to take advantage of the Tinubu tax reform which presents a golden and unique opportunity for Abia State citizens and businesses to thrive. With its favorable business environment, improved infrastructure, skilled workforce, and business-friendly policies, Abia State is currently rated an A+ and an attractive destination for investors and entrepreneurs. Abia State under Governor Alex Otti has caught the attention of several global and local agencies as an investor’s delight. Here are four Institutions that have taken notice The Abia Global Economic Advisory Council, has worked tirelessly to make Abia a preferred investment destination for global businesses. In reviewing their their work so far, concluded that Abia State is positioned to harvest positively from the traffic of investors lining up to do business. Secondly, BusinessDay, a reputable business publication has highlighted Governor Otti’s efforts to make Abia an investment destination, attracting nearly $200 million in private investments. Thirdly, The Innovate Africa Conference where Governor Otti’s keynote speech showcased his administration’s determination to make Abia an investment destination, creating new opportunity zones for investors. Has signalled the improved ratings of the State and finally in The National and International Business Communities, Governor Otti’s economic policies and initiatives have sparked interest among national and international business communities, with notable figures like Sanusi, Idika Kalu, Oteh, and Nwachukwu taking notice of Abia’s investment potential. Therefore, dear Abians before the Tinubu tax reform takes effect, Abia-born industrialists and Nigerian businesses are encouraged to take advantage of the state’s favorable business environment and register their headquarters in Abia State today.

As Nigeria’s economy continues to grow and diversify, the Tinubu tax reform will play a crucial role in attracting investors and entrepreneurs to the country.

As the Tinubu tax reform takes effect, it is essential for Abia-born industrialists and Nigerian businesses to be aware of the opportunities and challenges that the reform presents. By understanding the reform’s provisions and implications, businesses can position themselves to take advantage of the opportunities that the reform presents and minimize any potential challenges.

Dr Chukwuemeka Ifegwu Eke writes from the University of Abuja Nigeria.